U.S. States with Minor Natural-Gas Extraction

L. David Roper

http://www.roperld.com/personal/RoperLDavid.htm

23 November, 2016

World Fossil Fuels Depletion

Introduction

The extraction and reserves data for the curves below were obtained form the Energy Information Agency and a few other sources. The function used to fit the extraction data is a sum of Verhulst functions.

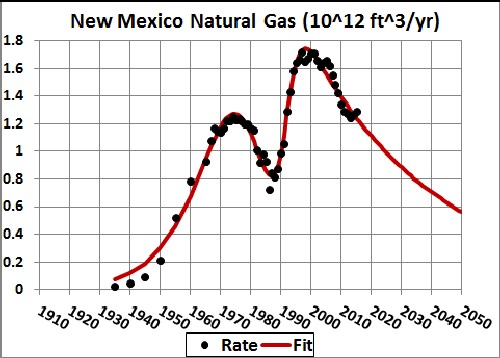

New Mexico

Total to be extracted = 131 x 1012 ft3; reserves = 56 x 1012 ft3

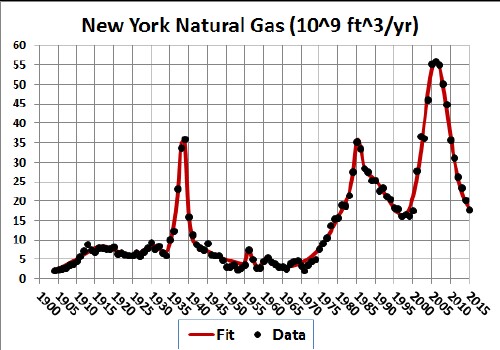

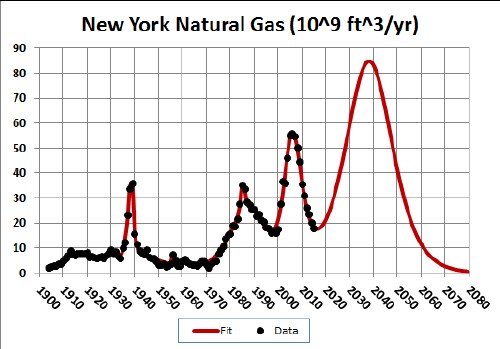

New York

|

|

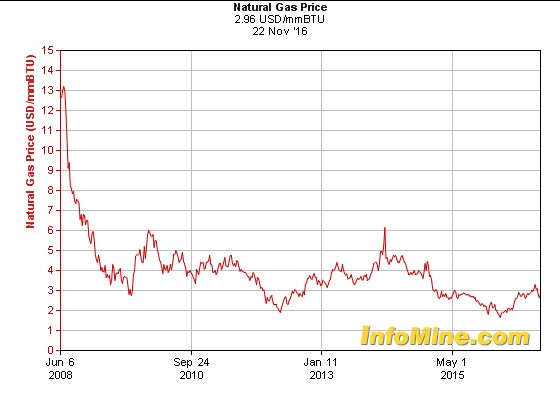

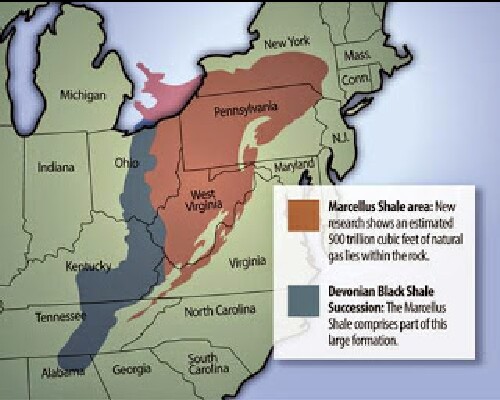

New York has a ban on fracking natural gas. The future peak shown above is an estimate of natural gas extraction in New York if the ban were lifted. The November 2016 price of natural gas in the U.S. is ~$3/103-ft3; so the 2.2 x 1012 ft3 is worth ~$6.6 x 109 in the current market. The average cumulative extraction for a Marcellus gas well is 1.56 x x 109 barrels. So, ~1400 wells would need to be drilled. An average well costs ~$7 x 106; so, the total cost of drilling the wells would be ~$9.8 x 109, about ~$3.2 x 109 more than the value in the current market. Natural-gas price would have to be $4.45/103-ft3 in order to break even. The price would have to be $4.90/103-ft3 in order to make a 10% profit.

Here is the natural-gas price since June 2008:

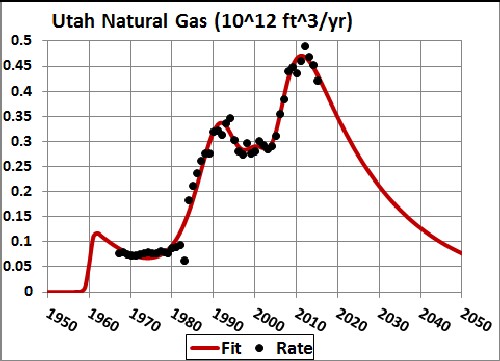

Utah

Total to be extracted = 29 x 1012 ft3; reserves = 16 x 1012 ft3.

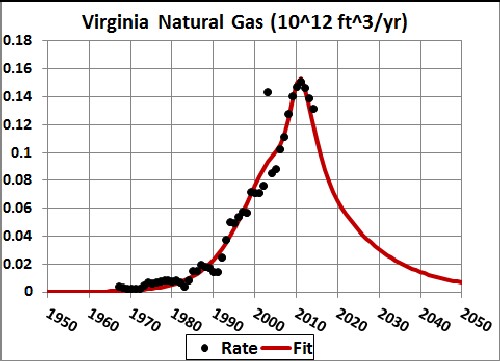

Virginia

Total to be extracted = 3.7 x 1012 ft3; reserves = 1.4 x 1012 ft3.

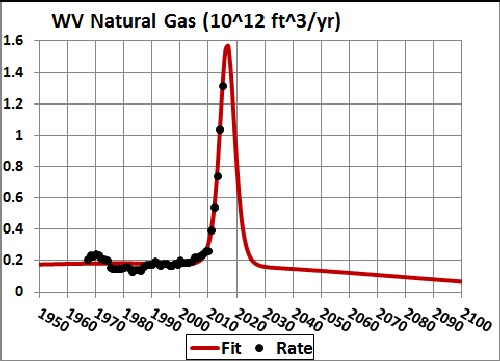

West Virginia

Total to be extracted = 60 x 1012 ft3; reserves = 20 x 1012 ft3.

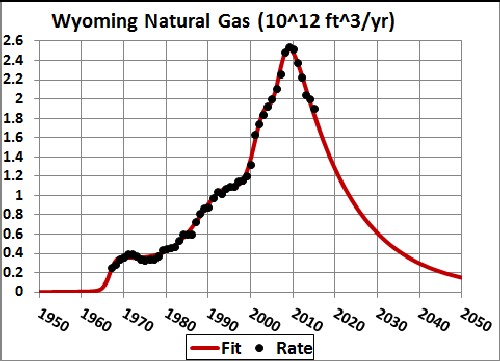

Wyoming

Total to be extracted = 86 x 1012 ft3; reserves = 33 x 1012 ft3.